While Initial Coin Offerings (ICOs) and cryptocurrencies remain the talk of the investment world, many investors remain cautious about getting involved. As the Financial Conduct Authority warned last year, like cryptocurrencies in general, the value of tokens may be extremely volatile, and could even go to zero.

The problem with cryptocurrencies is that many of them arguably have no intrinsic value. Shares in a public company for example have an intrinsic value as they are backed by the assets of the business and its cashflows. In contrast, cryptocurrencies such as Bitcoin are only worth what other investors are willing to pay for them – there are no other assets backing them and setting a minimum price. As such, in theory they could easily go to zero if users lose confidence.

One class of ICO aiming to reduce the risks of their associated coins being too volatile are known as “asset backed crypto”.

For example, in October last year Norwegian firm Intex Resources announced it is planning an ICO which will offer tokens that are backed by its own iron ore and nickel ore reserves. In Venezuela President Nicolas Maduro recently announced the launch of the “petro”, a digital currency backed by oil & gas and gold reserves, in order to bypass US sanctions. And in South Africa the Zabercoin is being backed by real estate assets.

In theory, the value of such tokens should only ever fall to the value of the underlying asset, thus limiting the downside. Therefore, investors concerned with the high levels of volatility being seen amongst a number of cryptocurrencies at present might want to take a look at an asset backed coin/token in order to reduce their risk of losing money.

Crowd for Angels is currently looking to raise £50 million via the issue of its “Liquid Crypto Bond”, a straight bond paying 4% interest per annum over 5 years. Along with the bond issue investors will be issued with up to 99 “ANGEL” tokens as a reward for investing in the bond at no extra cost. While having no value at the outset, the tokens are expected to be listed on external exchanges, along with Crowd for Angels’ own internal exchange, where the forces of market supply and demand will create a price for them.

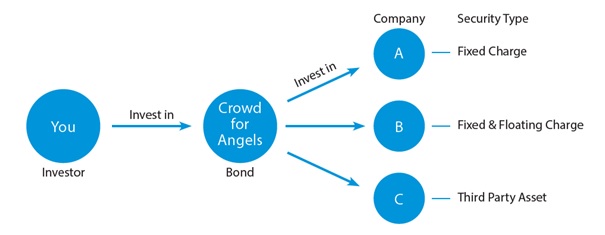

While the ANGEL token is not backed by any assets, the Liquid Crypto Bond itself does have indirect asset backing as the proceeds will be used to invest in a range of asset backed crowd bonds listed on the Crowd for Angels platform (see chart below). The proceeds earned from these crowd bonds, which are typically backed by property, inventories, intellectual property, or other company assets, will then be used to pay interest and capital due on the Liquid Crypto Bond.

Liquid Crypto Bond use of funds and example asset backing

For more information on the bond issue and ICO visit https://crowdforangels.com/company/plc/Crowd-for-Angels-UK-Limited-1031