| Min | Max | |

|---|---|---|

| Investment Target | £300,000 | £300,002 |

| Share Price | £2.00 | £2.00 |

|

Shares Offered

|

150,000 | 150,001 |

|

Percentage Offered

|

13.04% | 13.04% |

|

Shares Issued

|

1,000,000 | |

| Pre-money Valuation | £2,000,000 | |

| Share Type | Ordinary | |

| Minimum Investment | £100.00 | |

| Tax Relief Available | SEIS & EIS | |

| Sector | IT & Telecommunications Other FinTech |

|

| Location | Edinburgh, United Kingdom | |

| Company Number | SC631014 |

|

Ocyan was founded in November 2017 and has traded through its subsidiary Zerovertex. Its headquarters are in Edinburgh with an office in London. Ocyan is a Cloud & Blockchain innovation company for the FinTech industry and has paying corporate costumers in the Financial sector space.

Ocyan is seeking £100,000 on the Crowd for Angels platform of a maximum of £300,000 investment under SEIS/EIS. Ocyan has received commitments totaling £200,000 from Quintessentially Ventures Limited and from Wayra, the scale-up arm of Telefonica, who are both expected to participate in this round. Additionally, Wayra will participate with £34,000 in services to join the round. Ocyan is offering £60,000 under SEIS on a first-come basis and the balance under EIS.

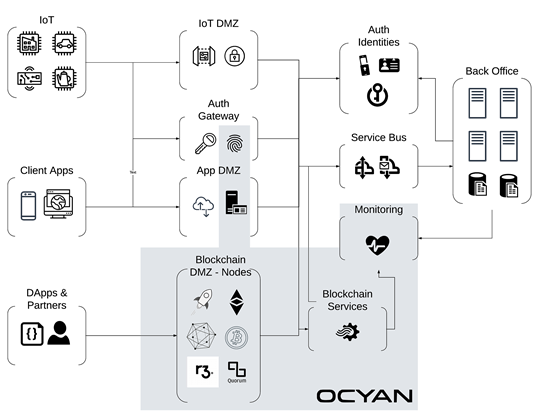

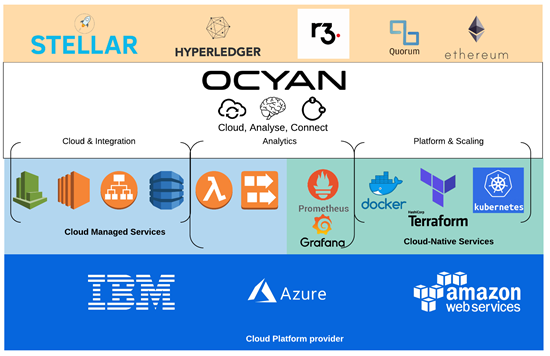

Ocyan has been actively engaged with use cases from Tier-1 to Tier-3 organisations within the FinTech, Logistics, Energy, O&G and Telecom industries who have been trying to scale, deploy and manage blockchain applications within their enterprise environment. Our On-premise "Cloud Operating System" provides features such as the formation and management of trusted and secure blockchain consortia, back-office and legacy integrations with blockchain and P2P networks, and serverless data pipeline for any blockchain network.

Peer-to-Peer (P2P) technologies are disrupting markets and rapidly gaining traction in all industries. Merging new technologies with enterprise-grade systems is complicated. It requires a "Cloud Operating System" that can deploy, manage and connect legacy infrastructure with any kind of P2P technology. Ocyan enables the disruption of traditional industries with emerging technologies. Providing an end-to-end cloud solution for enterprise blockchains is only the beginning.

Ocyan follows the enterprise-software distribution model, through which we partner as a vendor to different service providers and agencies as a close-partner solution for their infrastructure and SLA requirements. The engagement model follows a licensing cost depending on the use of the platform, the level of support and enabled features.

Our growth strategy is to engage with organisations that have already taken the decision to innovate with P2P Fintech and Blockchain solutions, though they are looking for a solution to scale, deploy and integrate their new ventures to production.

Over the past 2 years, we have seen heavy investment in Blockchain technology, with numerous enterprise blockchain PoCs (Proof of Concepts). The market is estimated to spend $23Bn on blockchain adoption in the next 4 years.

According to Barclays, Deloitte and PWC reports, 95% of companies are investing to expand their business to blockchain technologies, whilst 16% are aiming to invest >$10 million, and 30% in UK & EU aim to invest >$1m for their digital expansion. Ocyan is operating in a market with the potential of becoming the go-to technology enabler for this kind of business use-cases.

For 2019 alone, according to Deloitte’s 2019 Global Blockchain Survey, 45% of emerging disruptors have already started integrating with blockchain solutions.

PoCs are great tools to explore potential new models in a sandboxed agile environment, separate from the rest of the organisation. It gives the team to scope a creative mission, with a fixed budget and expected outcome without impacting the rest of production with something unstable.

But what happens when the PoC is a success? How do you go from pre-production to production? How do you test the new model against legacy integrations, bureaucratic operations, Production SLAs and Quality Assurances?

At Ocyan we believe we have successfully pioneered and delivered the world’s first production-ready platform that provides the complete enterprise environment for blockchain applications.

Tier-1 to Tier-3 Orgs from FinTech, Logistics, Energy, O&G and Telecom industries who have been trying to scale blockchain applications within their enterprise environment. The target market will possess the following characteristics:

Platform providers that want to extend their offerings to Cloud-Blockchain features

Organisations that have spent over £2-3M, or started forming a blockchain team

Enterprises whose industry is being disrupted by DLT consortia

Enterprises whose direct competitors are introducing new business models by using DLT technologies

Supplies who provide consultancy support directly to larger organizations

Cloud & Server providers who want to offer managed solutions over their network

Enterprises who want to innovate with DLT solutions, to lower down the cost of trading, by eliminating the interaction needs of third-party suppliers in their supply chain, examples; Finance & insurance; credit scoring, banking products, insurance products

Ocyan's marketing strategy for the next 18 months includes the following:

Activating vendor partnerships with large tech and service providers. This gives Ocyan access to deploy its platform directly to larger corporates (distribution channels)

Integrating with Blockchain consortia

Educational webinar presentations

Development of a Knowledge Base

Attending targeted Enterprise Summits & Events

Attending technical meetups

Targeted reach-out to Tech-leads and CIOs of companies that fall into the targeted segmentation market

Partnering with accelerators, that give us access directly to their commercial team

To find out more about this pitch or to ask the Director(s) a question please Join Now or Log in below

|

|

|

|

Discover investment opportunities, support companies you believe in and share their success Take advantage of SEIS/EIS tax relief to minimize your tax and the opportunity to obtain high-interest rates.

With us, you can gain access to great UK companies offering Shares, Crowd Bonds or Digitalised Assets through our easy to use online platform.

To find out more about this pitch or to ask the Director(s) a question please Join Now or Log in below

|

|

|

|

Discover investment opportunities, support companies you believe in and share their success Take advantage of SEIS/EIS tax relief to minimize your tax and the opportunity to obtain high-interest rates.

With us, you can gain access to great UK companies offering Shares, Crowd Bonds or Digitalised Assets through our easy to use online platform.

To find out more about this pitch or to ask the Director(s) a question please Join Now or Log in below

|

|

|

|

Discover investment opportunities, support companies you believe in and share their success Take advantage of SEIS/EIS tax relief to minimize your tax and the opportunity to obtain high-interest rates.

With us, you can gain access to great UK companies offering Shares, Crowd Bonds or Digitalised Assets through our easy to use online platform.

To find out more about this pitch or to ask the Director(s) a question please Join Now or Log in below

|

|

|

|

Discover investment opportunities, support companies you believe in and share their success Take advantage of SEIS/EIS tax relief to minimize your tax and the opportunity to obtain high-interest rates.

With us, you can gain access to great UK companies offering Shares, Crowd Bonds or Digitalised Assets through our easy to use online platform.

To find out more about this pitch or to ask the Director(s) a question please Join Now or Log in below

|

|

|

|

Discover investment opportunities, support companies you believe in and share their success Take advantage of SEIS/EIS tax relief to minimize your tax and the opportunity to obtain high-interest rates.

With us, you can gain access to great UK companies offering Shares, Crowd Bonds or Digitalised Assets through our easy to use online platform.

| Min | Max | |

|---|---|---|

| Investment Target | £300,000 | £300,002 |

| Share Price | £2.00 | £2.00 |

|

Shares Offered

|

150,000 | 150,001 |

|

Percentage Offered

|

13.04% | 13.04% |

|

Shares Issued

|

1,000,000 | |

| Pre-money Valuation | £2,000,000 | |

| Share Type | Ordinary | |

| Minimum Investment | £100.00 | |

| Tax Relief Available | SEIS & EIS | |

| Sector | IT & Telecommunications Other FinTech |

|

| Location | Edinburgh, United Kingdom | |

| Company Number | SC631014 |

|