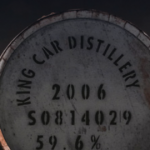

Raise a glass to investing in whisky

Alternative investments is an interesting area of the market which is all about putting money into non-traditional assets – by non-traditional we mean anything that isn’t a share or a bond such as investing in whisky. This covers a range of things including art, commodities, wine, stamps, coins and even classic cars. Many investors consider […]

Tokenised Securities: Is 24 hour trading a good idea?

One of the benefits often discussed with regards to tokenised securities, is that by putting them on the blockchain they will be able to be traded at any time of the day. This is in contrast to most traditional financial markets, like the London Stock Exchange, where trading in equities is only permitted between certain […]

Why an STO? (Security Token Offering)

By Andrew Adcock, CEO, Crowd For Angels In 2018, many publications mooted that ‘this was the year of the STO’. Yet for all that hype, you would be right in wondering what had actually been delivered. Unlike the ICO boom of late 2017, we did not see the flood gates open and funds pour in […]

Security Tokens in 5 Images

There has been an explosion in the interest surrounding security tokens and STOs (Security Token Offerings) also known as Digitalised Assets. Unlike ICOs, that relied heavily on the value appreciation of a ‘utility’ token, security tokens benefit from real-world assets they represent. This connection helps bridge the gap between traditional finance and the blockchain world. […]

Security Token Offerings — A Brighter Future

Tokenised Assets and Security Token Offerings are vying to spark adoption and legitimise the industry. Many Initial Token Offerings (ITOs) have failed mainly due to bad execution, lack of transparency and accountability. Data clearly indicates a continued slowdown in the total capital raised by ITOs since June this year. This slump is supported by the […]