Final vote on EU rules for crowdfunding platforms

Original article featured on the European Union, check here (Monday, 5 October) On Monday evening, the plenary approved the deal struck with the Council last December on common rules to boost EU crowdfunding platforms and protect investors. The new rules aim to help crowdfunding services to function smoothly in the internal market and to foster […]

New announcement on the Future Fund.

FUTURE FUND EXTENDED TO UK COMPANIES FROM ACCELERATOR PROGRAMMES OUTSIDE THE UK 30 June 2020 The Chancellor of the Exchequer today announced that the Future Fund is being expanded to accommodate businesses that contribute significantly to the UK economy, but do not have their parent company based in the UK because they participated in a […]

Tackling terrorism with new anti money laundering laws

Regardless of the UK’s status as a member of the European Union, next year is set to see changes to the country’s anti money laundering and terrorist financing laws. Approved last May by the EU Council, the 5th Anti-Money Laundering Directive (AML5) is binding on all member states, tightening the rules for financial services firms […]

Crowd for Angels secures £550,000 in funding and lists ANGEL token on new exchange

Crowd for Angels is delighted to announce that its latest equity funding round has surpassed its funding target as it secures funding of £550,930. Following support from both existing and new shareholders, including a significant investment from invoice finance firm Populous World, Crowd for Angels secures funding totalling £550,930 which is ahead of initial target […]

CBD – not just an investment fad

Along with blockchain, one of the recent investment booms has been in the area of cannabis. While the recreational use of cannabis remains largely illegal around the world (but not in countries including Canada), the global trend is now firmly towards the liberalisation of regulations, especially in the areas of medicinal cannabis. Cannabinoids Cannabis itself […]

Crowd for Angels and UCK Network London Meetup Attracts Large Attention

24th July 2019/London/ UCK Network and Crowd for Angels London Meetup was held in Cocoon Global, London. The co-founder of UCK Network, Gilbert Zheng and International Communications Consultant, Helen Zhang have attended the meetup and shared the latest information of UCK Network. This is UCK Network’s another international meetup after a series of appearances in […]

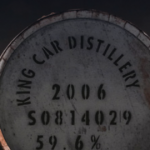

Raise a glass to investing in whisky

Alternative investments is an interesting area of the market which is all about putting money into non-traditional assets – by non-traditional we mean anything that isn’t a share or a bond such as investing in whisky. This covers a range of things including art, commodities, wine, stamps, coins and even classic cars. Many investors consider […]

Crowd for Angels shortlisted as a finalist in the Growth Finance Awards

25 June 2019: Crowd for Angels has beaten off tough competition to secure itself a place as a finalist in the Best Use of Technology category of the first-ever Growth Finance Awards. The Growth Finance Awards launched this year in order to celebrate the companies providing “more than finance” to the UK’s growing businesses. It’s […]

What we learned from Fintech Week – Venture Capital (VC)

Crowd for Angels’ Chief Marketing Officer Andrew Adcock recently chaired a panel of four venture capital industry experts at the London Fintech week

4th UK Alternative Finance Industry Report

Cambridge Centre for Alternative Finance releases the 4th UK Alternative Finance Industry Report supported by CME Group Foundation. The report finds that the UK online alternative finance market grew 43 per cent in 2016 to reach £4.6 billion in 2016. Download the report