Hidden secrets about the SEIS and EIS Tax Relief Schemes

The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) are established government incentives that aim to encourage investment in smaller companies. They do this by providing investors with generous tax benefits. Despite being fairly popular schemes amongst both companies and investors, there are still various details about the schemes that go unnoticed. Below […]

Investor’s Guide to the EIS & SEIS

Crowd for Angels presents the Investor’s guide to the Enterprise Investment Scheme and Seed Enterprise Investment Scheme. The guide explains who Crowd for Angels are, the Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), their main benefits and how one can claim each tax relief. Read the Investor’s Guide below. The Enterprise Investment Scheme, […]

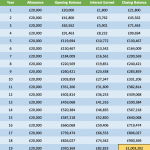

How long would it take to become an Innovative Finance ISA Millionaire?

“…in this world nothing can be said to be certain, except death and taxes.”, so wrote Benjamin Franklin. The late great comedian Ken Dodd did his best to avoid both, unfortunately succumbing to death last year aged 90. Fortunately, while both are inevitable, there are many ways that UK investors can legally reduce their tax […]

VCT vs EIS – what’s the difference?

Want to save on your tax bill and invest in growing companies at the same time? With a range of government backed incentive schemes you can do exactly that. Small businesses are the lifeblood of the UK economy. They employ an estimated 16 million people (more than half of the workforce), account for 99.3% of […]

Tax Advantage of BIR for UK Resident Non-Domiciliaries

You might think that with the budget of last week, it is all gloom for non-doms. However, it would pay to revisit a previous government initiative.

On 6 April 2012, the government introduced the very attractive Business Investment Relief (“BIR”) for non-UK domiciliaries. This is relevant if you are currently a resident in the UK, are treated for tax purposes as non- domiciled (non-dom), and have overseas income and gains.

Is SEIS / EIS tax relief available for investments in foreign companies?

On the first glance, It does not seem likely that the UK government would be that generous with its revenue. Nevertheless, these tax reliefs are available to investors in certain instances.

To be eligible for the relief, the company seeking the investment must have:

1. A permanent establishment in the UK for a period of 3 years from the issue of the shares.

2. All the money raised by the share issue must be used within two years in a ‘qualifying trade.’

3. The trade must be carried on by the parent company or subsidiary which is a 90% subsidiary for a period of 3 years from the issue of the shares.