“…in this world nothing can be said to be certain, except death and taxes.”, so wrote Benjamin Franklin. The late great comedian Ken Dodd did his best to avoid both, unfortunately succumbing to death last year aged 90. Fortunately, while both are inevitable, there are many ways that UK investors can legally reduce their tax bill, not least via the ever popular Individual Savings Account (ISA).

Since they were launched in 1999 ISAs have been the go-to product for consumers looking to shelter their savings income from the taxman. According to statistics from HMRC, at the end of the 2017/18 tax year the total market value of Adult ISA holdings stood at a mammoth £608 billion – that’s more than the annual GDP of Saudi Arabia! However, well under 1% of this value was made up by holdings in the relatively new Innovative Finance ISA (IF-ISA).

Launched by the government in April 2016 the IF-ISA enables investors to earn tax-free returns on loans and bonds issued by peer-to-peer (P2P) lenders and crowdfunding companies by putting them within the ISA wrapper. These typically take the form of business or consumer loans, whereby investors directly lend to companies looking for growth capital or to individuals looking to borrow money.

The IF-ISA occupies a middle ground between Cash and Stocks & Shares ISAs in terms of both risk and returns. Various IFISA providers have target rates of return starting at around 4% up to as high as 12%. Of course it involves more risk than the theoretically risk free Cash ISA but is less risky than investing in more volatile equities.

After a slow start, investors now seem to be taking to the IFISA

According to statistics from HMRC, the IF-ISA attracted £290 million in subscriptions in the 2017/18 tax year across 31,000 accounts. That soared from just £36 million across 5,000 accounts in the previous year. Some commentators are expecting the figure to hit £1 billion for 2018/19 as knowledge of the product increases and investors become more attracted to the IF-ISAs “halfway house” status.

Make a million

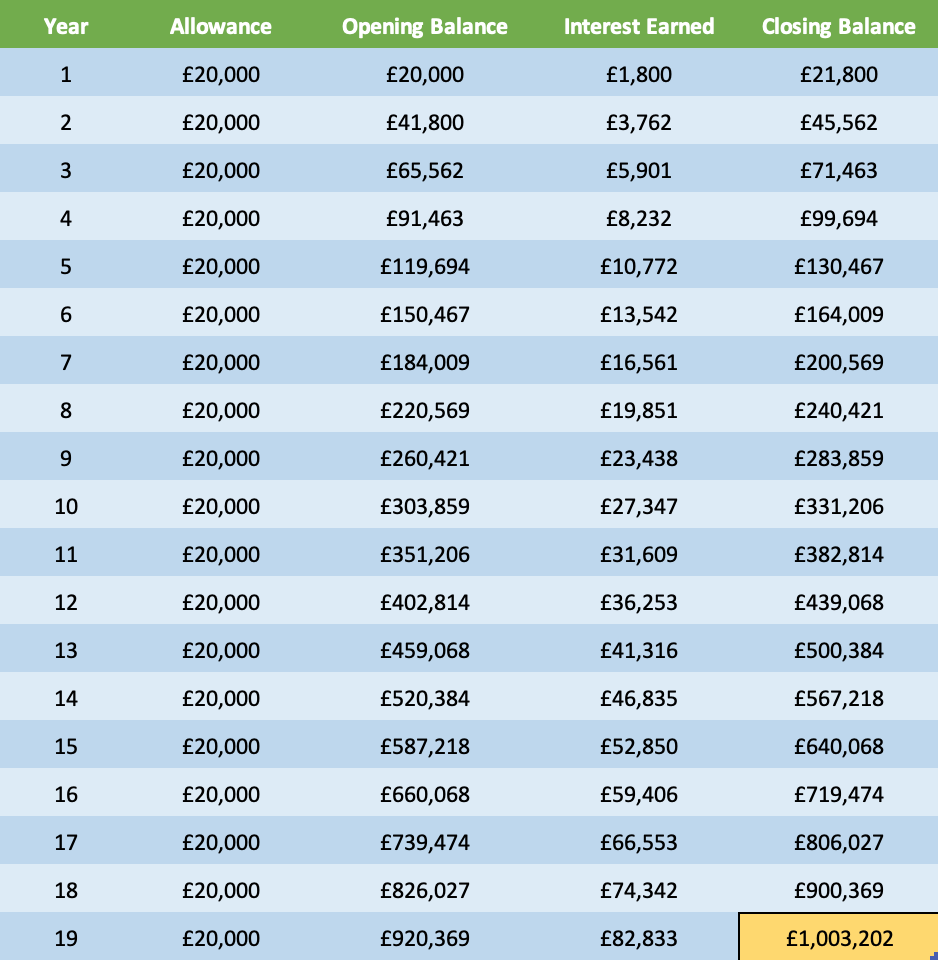

For investors with enough cash to take advantage of the full (and generous) £20,000 annual ISA allowance, it is interesting to show just how quickly their funds can grow into a million pounds. This is illustrated in the table below. Our calculations assume a 9% annual return (a target rate of return of some IFISA providers) paid at the end of the year, £20,000 annual investment at the start of the tax year and that interest payments are immediately invested at the same rate.

Taking advantage of the tax free returns and combined with the wonder of compound interest, the table shows that investors could become IFISA millionaires within just under 19 years.

For more information on the IFISA and to open one with Crowd for Angels CLICK HERE