Amongst the range of business support measures announced by the government in the past two months is the Future Fund. Delivered by the British Business Bank (like the CBILS programme), the Future Fund has been designed to ensure high-growth companies across the UK receive the investment they need to continue during the crisis. Unlike CBILS, the programme is focusing on the provision of convertible loans, thus offering companies a flexible method of financing, while giving investors the potential of equity upside in the long-term.

Future Fund

The Future Fund will initially be a £500 million scheme, with half of this amount committed by the government and the remainder required to be raised from other investors. In effect, the government is matching, pound for pound, any money raised from external investors. The fund will provide UK-based companies with loans between £125,000 and £5 million, with the loans automatically converting into equity in the company at its next qualifying funding round or at the end of the loan if not repaid.

The loans will have a three year term and a minimum interest rate of 8% per annum, with this accruing until the loan converts – i.e. investors will not be paid cash interest payments over the term of the loan. The loan cannot be repaid early by the company other than with the agreement of all of the investors. Also, loans will convert at a minimum 20% discount to the relevant share price on the conversion date.

To be eligible, a business must be a private UK registered company that has previously raised at least £250,000 in equity investment from third party investors in the last five years. Investors must also meet certain criteria to invest in the loan, including being an investment professional, high net worth investor or sophisticated investor.

The Future Fund will initially be open until the end of September 2020 and its scale will be kept under review. There are a few restrictions on how companies can use the funds, with the repayment of borrowings not allowed, nor the payment of dividends, bonuses or advisory fees. You can find out more here https://www.uk-futurefund.co.uk/s/

Convertible loans

Convertible loans are a type of financial instrument with have elements of both debt and equity. They are typically used by fast growing, early stage companies looking to raise finance, while also looking to reduce cash outgoings with the conversion element. While initially having loan like characteristics, they have imbedded terms which mean that amounts due (capital and/or interest) can be converted into shares in the borrowing company at some point in the future. To incentive investors, the loans typically convert at a discount to the share price at the conversion date.

Example

So how will the Future Fund work for a company? A basic calculation is best illustrated by a simple example:

Will’s Widgets raises £1 million via a three year convertible loan at a simple interest rate of 8% per annum. At the end of the three years £1.24 million is owed to investors. Instead of paying the amount due in cash, instead the loan is converted into shares in the company. The company’s share price is now deemed to be £2 per share, with the note converting at a 20% discount.

The number of shares to be issued are calculated as follows:

| Amount due: | £1,240,000 |

| Conversion price: | £2.00 x 0.80 = a conversion price of £1.60 |

| Number of shares to be issued: | £1,240,000/£1.60 = 775,000 shares |

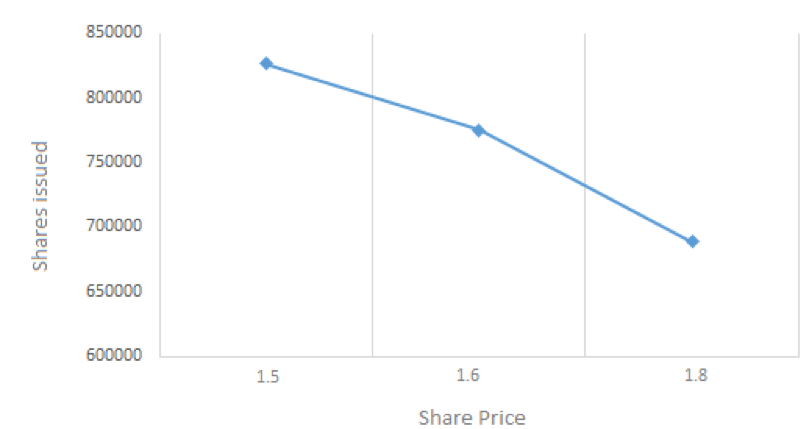

Note: The number of shares to be issued increases the lower the conversion price and conversely the number reduces if the conversion price is greater. For example, if the conversion price was £1.50 the number of shares to be issued would be 826,667. If the price was £1.80 then only 688,889 shares would be issued as shown in the graph below.

The cost to the company can be viewed in terms of dilution.

Say that Will’s Widgets had a share price of £1.00 when it decided to raise the funds. If the company had tried to raise funds via equity at that time it would have to issue 1 million shares. In three years’ time, over which time the company has put the funds to use and seen its share price double, only 775,000 shares have to be issued as per the convertible loan terms.

So the conversion terms are fairly favourable for a company that sees a doubling of its share price over the three years. This is a simple illustration and there may well be other factors such as cost of money, tax and terms within the loan conversion documents.

For more information on convertible loans and how Crowd for Angels can help raise finance for your business visit https://crowdforangels.com/convertible-loans

The above opinion was written by Tony De Nazareth, a Fellow of the Chartered Accountants Institute of England & Wales, an Associate Member of the Association of Corporate Treasurers and Director of Crowd for Angels, an FCA regulated crowdfunding platform.

Comments are closed, but trackbacks and pingbacks are open.