Driven by increasing life expectancy rates and record low interest rates, levels of income provided by annuities have plunged over the past couple of decades. Back in the 1990s a 65 year old man with a pension fund of £100,000 could quite easily secure an income of c.£15,000 a year until death via a life annuity. However in 2016 an equally large pension pot is unlikely to pay our retiree more than £5,000 per annum.

Investors with a more adventurous appetite for risk and who are looking to secure higher rates of long-term income might want to turn to the crowdfunding sector. A range of peer-to-peer and other platforms currently offer a variety of long-term debt products which offer more attractive rates compared to those of annuity providers. And the recently launched Innovative Finance ISA (IF ISA) offers the opportunity to further boost returns via its tax free wrapper, should the loans be eligible.

Renewable energy company ECH Property Solutions is currently looking for debt finance on the Crowd for Angels platform in order to buy a portfolio of income generating solar power consumer credit agreements.

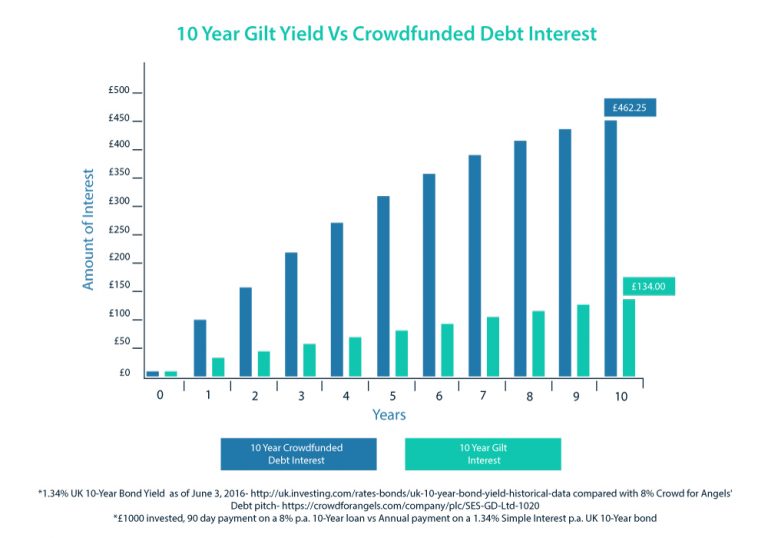

The company is looking for up to £205,000 in investment via a 10 year capital repayment loan at an interest rate of 8%, with repayments being made every 90 days. The loan is also secured by a fixed charge on the underlying credit agreements. These are expected to provide a consistent stream of cashflow over a 20 year period and be more than sufficient to cover the loan repayments.

To illustrate the income on offer, a £1,000 investment in the loan will deliver payments of just under £36.5 every 90 days (or £146 per year) for 10 years.

For more information on the ECH Property Solutions loan pitch CLICK HERE

Be aware that on capital repayment loans the interest rate stated represents the gross return earned if you immediately re-invest all repayments (interest and principal) received over the course of a year at the same level of interest. Of course, risks are higher if you lend to only one business so as ever it should only be done as part of a diversified portfolio. Capital at risk.