Since its launch in 1999 the Cash ISA (Individual Savings Account) has been a very popular product for consumers looking to shelter their savings income away from the taxman. According to government statistics, at the end of the 2015/16 tax year the total market value of Cash ISAs was a mammoth £250.7 billion¹.

Savers have been attracted to the product due its tax free “wrapper”, along with assurance from the government that up to £85,000 of deposits will be protected should a bank go bust. However, it’s no secret that returns from Cash ISAs over the past few years have been derisory.

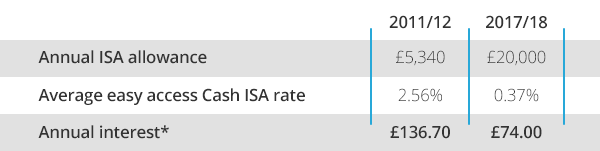

According to data from personal finance website Moneyfacts, the average easy access Cash ISA rate fell from 2.56% in January 2012 to just 0.37% in May this year². Over that time the annual ISA allowance has almost quadrupled from £5,340 to £20,000. But given the fall in rates, even savers who are now taking up their full allowance are earning less tax-free income than they were 5 years ago, as the table below shows.

*assuming all of the allowance is invested at the start of the tax year

Not only are savers having to contend with falling interest rates, they now have to face the challenge of rising inflation. Having been at or near 0% for all of 2015, and below 1% for much of 2016, the CPI measure of inflation moved to 2.7% in April this year. That’s its highest level since September 2013 and even higher than in Zimbabwe! What this means is that UK easy access Cash ISA savers are now receiving a negative real return on their money.

But for investors and savers willing to take on extra risk there is the potential to boost returns.

Launched by the government in April 2016 is the Innovative Finance ISA (also known as the IF-ISA). It enables investors to earn tax-free* returns on loans and bonds issued by peer-to-peer (P2P) lenders and crowdfunding companies by putting them within the ISA wrapper. These typically take the form of business loans, whereby investors lend their money to companies looking for growth capital.

*The availability of any tax relief depends on individual circumstances and is subject to change in the future. Capital at risk

The main attraction of these financial assets, such as the “crowd bonds” offered by Financial Conduct Authority (FCA) regulated crowdfunding platform Crowd for Angels, is that the interest rates on offer are higher than on Cash ISAs – up to 12% in some cases. What’s more, they can be used within the overall ISA allowance in order to boost returns – the ISA allowance can be used in any proportion across Cash, Stocks & Shares and IF-ISAs.

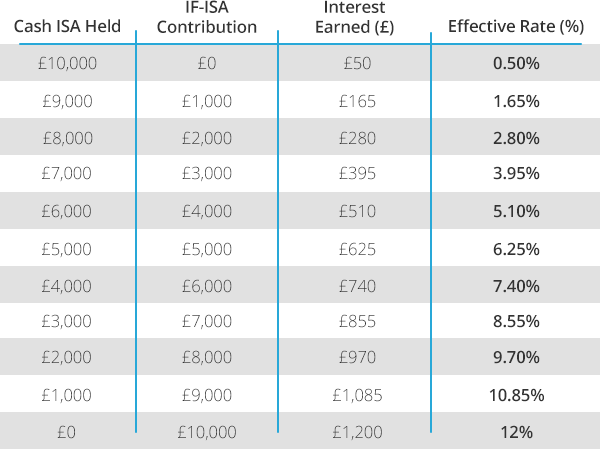

For example, if you have £10,000 in your Cash ISA, earning 0.5% annual interest, you will get £50 interest after one year. You could increase the overall effective interest rate by transferring some money from a Cash ISA account into a 12%, IF-ISA eligible crowd bond. For instance, if you moved £1,000 from the Cash ISA to the crowd bond, the total interest would be £165 (£45 on the Cash ISA and £120 on the crowd bond), which equates to an effective interest rate of 1.65%. Moving £5,000 in the same way results in an effective rate of 6.25%.

TABLE: EFFECTIVE ANNUAL INTEREST RATES ON DIFFERENT CASH/IF-ISA CONTRIBUTIONS

Assumptions: Total £10,000 invested. 0.5% Cash ISA rate, 12% IF-ISA rate and all money invested at the start of the tax year.

To give one example of a crowd bond, car finance business, The Asset Exchange, is currently looking for investors through Crowd for Angels. The company is seeking up to £300,000 by issuing a crowd bond and in return is offering interest of 12% p.a., paid monthly, fixed for 18 months. The minimum investment is £100.

Of course, like with any investment, the increased returns offered by crowd bonds come with higher risk.

The 12% being offered on The Asset Exchange crowd bond is in contrast to a current best rate of 1.25% on a 2 year fixed rate Cash ISA³. But lending money to businesses puts investors at risk of the company not paying back the capital or interest which it owes. So in other words, some or all of your capital is at risk by investing in crowd bonds, with Cash ISA deposits largely considered to have very low capital risk.

Additionally, unlike with Cash ISAs, there is no Financial Services Compensation Scheme to fall back on should the product provider (crowdfunding/P2P platform) go into default. You should also be prepared to hold crowd bonds for their full duration as they are not likely to be readily realisable should you need your capital back quickly.

Risk Warning

The content of this email is for information purposes only and should not be considered as investment advice. You should consult an appropriately qualified financial advisor if you are in any doubt as to the suitability of the product you are considering.

Investing in debt pitches through Crowd for Angels (UK) Limited involves lending to companies and therefore your capital is at risk and interest payments are not guaranteed if the borrower defaults. It should be done only as part of a diversified portfolio. Crowd for Angels is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own Investment Decisions. You will only be able to invest via Crowd for Angels once you are authorised.

Please click

here to read the full Risk Warning.

The availability of any tax relief depends on the individual circumstances of each investor and of the company concerned and may be subject to change in the future. If you are in any doubt about the availability of any tax reliefs, or the tax treatment of your investment, you should obtain independent tax advice before proceeding with your investment.

Sources