The Rapid Growth of Crowdfunding for Equity

The Rapid Growth of Crowdfunding for Equity

Crowdfunding for equity may not be the most obvious investment option available, but it’s hard to argue against its ever increasing rise in popularity with investors.

Since 2011, when it first started gathering pace in the UK, equity crowdfunding has been viewed as an attractive opportunity for investors. However, all investments come with a certain amount of risk and the more innovative the investment model, the more scepticism there is from investors.

Understanding Angel Investors

One of the key components to successful crowdfunding is the involvement of angel investors who are proving to be a lucrative source of finance for businesses of all shapes and sizes.

It’s a good idea to understand exactly what an angel investor can bring to your business, so let’s take a look at their makeup and objectives.

Will Crowdfunding Pick Up the Slack of the Banks?

It is no secret that as a society, we are quickly losing faith in the banking system. As technology continues to grow, there is a fast approaching sub-sector in alternative finance that could provide us with a solution. Crowdfunding platforms have completely transformed how we approach business through the medium of new technology. The good news doesn’t stop there.

Tax Advantage of BIR for UK Resident Non-Domiciliaries

You might think that with the budget of last week, it is all gloom for non-doms. However, it would pay to revisit a previous government initiative.

On 6 April 2012, the government introduced the very attractive Business Investment Relief (“BIR”) for non-UK domiciliaries. This is relevant if you are currently a resident in the UK, are treated for tax purposes as non- domiciled (non-dom), and have overseas income and gains.

Millennial Generation Loves Crowdfunding: Will Industry Follow Suit?

The Millennial generation is increasingly interested in crowdfunding, an alternative financing system that allows members of the public to invest in a pitch before its completion. Many small companies have already caught onto this trend, and are using digital platforms to fund start-up and independent projects. However, crowdfunding isn’t just about getting a project completed.

Is SEIS / EIS tax relief available for investments in foreign companies?

On the first glance, It does not seem likely that the UK government would be that generous with its revenue. Nevertheless, these tax reliefs are available to investors in certain instances.

To be eligible for the relief, the company seeking the investment must have:

1. A permanent establishment in the UK for a period of 3 years from the issue of the shares.

2. All the money raised by the share issue must be used within two years in a ‘qualifying trade.’

3. The trade must be carried on by the parent company or subsidiary which is a 90% subsidiary for a period of 3 years from the issue of the shares.

What Marketing Opportunities Surround Companies who Crowdfund?

Crowdfunding is a popular way for small companies to raise money and provides many marketing opportunities that would otherwise be unavailable. Since many ideas that are crowdfunded are innovative and exciting, it levels the playing field for smaller companies to develop their products. It can be challenging for companies to create a successful crowdfunding campaign, but when done correctly, crowdfunding can be extremely effective. It offers the company a loyal following and the investment needed to create new products and services.

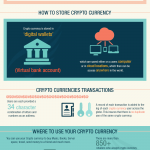

A Guide to Crypto Currency

Crypto Currency — Text from Image — A guide to crypto currency, providing you with the knowledge of how to use crypto currency. The government is to explore the role that digital currencies, such as Bitcoin, could play in the financial system. We have set out measures that will make Britain the global centre of […]

Crowd for Angels joins UK Crowdfunding Association

We are pleased to announce that Crowd for Angels are now proud members of the UK Crowdfunding Association (UKCFA).

The UK Crowdfunding Association was formed in 2012 by fourteen crowdfunding businesses. Their aims are to:

Promote crowdfunding as a valuable and viable way for UK businesses, projects or ventures to raise funds.

Be the voice of all crowdfunding businesses in the UK (donations, loans and equity) to the public, press and policymakers.

Publish a code of practice that is adopted by UK crowdfunding businesses.

Crowd for Angel’s director, Tony De Nazareth, said: “We are really glad to become part of this credible organisation and work towards improving the crowdfunding environment for both investors and companies. We will work hard to support the UKCFA’s values.”

‘Crowd for Angels provides funding for companies’ – Asian Voice

Tony De Nazareth, who has over 30 years’ experience in investment banking, venture capital and lending, has launched Crowd for Angels, a platform to provide funding for companies from the beginning till it is listed. The launch pitches include film company, The Series Ltd, which is looking to raise funds for TV drama, the Mughals, Bet Fast Ltd, a mobile software company and AIM listed company Advanced Oncotherapy, a provider of radiotherapy systems, which has a £22.7 m market cap and recently raised £6 m through traditional channels.